Gordon Associates and Long Term Care Insurance Timeline

In the early days, long term care was not widely available, as people generally didn’t live as long as they do today. The first signs of organized care emerged through women’s and church groups, which established special homes to support elderly individuals of the same religious or ethnic backgrounds. These efforts marked the beginning of a community-centered approach to elder care.

“With the expansion of the Social Security Act, Medicare and Medicaid positioned federal and state governments as the primary funders of long term care. These programs led to a significant increase in nursing home usage and government spending, while also driving the growth of home care and post-hospital care services.

The Social Security Act Amendments set federal standards for nursing homes, increasing funding for social services and establishing Medicaid as the primary payer for long term care (LTC) needs. This reliance on Medicaid spurred the creation of private long term care insurance (LTCI) products to help individuals manage costs beyond Medicaid’s coverage.”

A social insurance program was introduced to provide continuous income for retired workers aged 65 and older, playing a pivotal role in the rise of the private nursing home industry and aimed to reduce reliance among the aging population.

The first long term care insurance policy was sold by General Electric in 1974. While this concept was largely unfamiliar at the time, Murray Gordon recognized its potential and left his position in sales to dedicate his career to advancing LTCI, becoming a trailblazer in the industry.

In 1975, Murray Gordon founded Gordon Associates (GALTCI) from his home in Des Plaines, Illinois, just one year after the first LTCI policy was introduced. As a family-owned business, Gordon Associates has remained dedicated to education, supporting financial advisors, and serving as a trusted resource for long term care solutions.

Just one year after its founding, Gordon Associates began offering educational programs to clients and the local community. These programs focused on raising awareness about long term care planning and its impact on retirement and asset protection. Education quickly became a cornerstone of our mission, setting the stage for decades of trusted service.

Gordon Associates expands from its humble beginnings in Murray’s Des Plaines home to a dedicated office space in Park Ridge.

During the 1980s, long term care insurance evolved to include coverage for home care, offering individuals greater flexibility and independence. While this expansion was a significant shift in the industry, it did not encompass all the coverage options available today, as the market continued to evolve to meet diverse needs.

Murray Gordon worked closely with long term care insurance companies to introduce the Waiver of Premium (WOP) feature, which had previously been limited to disability income policies. Gordon Associates collaborated with insurance providers and actuaries to design plans that offered additional financial protection for policyholders facing a long term care event. Gordon Associates Long Term Care Planning’s founder, Murray Gordon has helped insurance companies introduce a number of consumer-friendly features for long term care insurance policies that are still included today.

GALTCI began offering Continuing Education (CE) programs for insurance agents, emphasizing the importance of long term care insurance in protecting assets and ensuring quality care. These programs highlighted how LTC coverage addresses gaps left by other insurance and medical plans. GALTCI also worked closely with clients to educate them on critical issues related to long term care planning.

The Nursing Home Reform Act of 1987 established new quality of care standards for Medicare and Medicaid-certified nursing homes, leading to increased costs for long term care (LTC) providers and higher claim payouts. These changes helped build greater public trust in both LTC insurance and nursing homes. Additionally, 1987 marked the year John Hancock sold its first long term care insurance policy, further expanding the industry’s reach.

In 1989, Gordon Associates partnered with CNA Insurance to offer the first affinity group discount for long term care insurance, providing policyholders with reduced rates through group enrollment. This innovative approach made LTC insurance more accessible and affordable for a wider range of individuals.

In 1990, Brian Gordon joined Gordon Associates, bringing new energy and expertise to the company. This period also marked significant growth in the long term care insurance (LTCI) industry, fueled by heightened awareness of the need for coverage, the introduction of more diverse policy options—including home care and assisted living—and the implementation of state-level tax credits, which made LTCI more attractive and accessible to a broader range of consumers.

GALTCI partnered with the Community Bankers Association of Illinois and retirement communities to expand industry presence through statewide educational programs for banks and their customers. Additionally, provided long term care solutions through financial planning divisions.

Brian Gordon was recognized by CNA as a First-Time Qualifier for Success in long term Care and earned their Outstanding Achievement Award. It’s a testament to his passion for delivering top-notch service and innovative care solutions.

Throughout the 1990s, long term care insurance (LTCI) gained popularity as the Baby Boomer generation began to age. With an increasing number of individuals approaching retirement, awareness of the need for LTC coverage grew, fueling demand for policies that could protect assets and provide care options. This demographic shift played a pivotal role in the expansion and mainstream acceptance of LTCI. During this time, inflation protection was introduced to combat the rising costs of LTC services.

GALTCI relocates to a new, expanded office space in Deerfield to accommodate business growth and support increased operations.

As a veteran in the insurance industry, Peter Florek joined GALTCI in 1996. He specializes in assessment, development and implementation of long term care plans for individuals, families and businesses with fewer than 500 employees. He also teaches continuing education classes and provides long term care support services for insurance and financial professionals across the country.

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) introduced tax qualified long term care insurance, offering financial relief and incentives for individuals and employers to invest in long term care coverage.

GALTCI began offering CFP credit for financial advisors, enhancing the value of our educational programs. We also joined NAPFA and attended their RENO conference, where we connected with numerous financial advisors eager to learn about long term care planning. This initiative opened the door for long-lasting partnerships with many financial advisors, solidifying our role as a trusted resource in LTC planning.

The Deficit Reduction Act of 2005 introduced new guidelines for long term care insurance, including the creation of Partnership Policies. These policies allowed individuals to protect more of their assets while qualifying for Medicaid benefits, promoting the use of LTCI as a strategy for asset preservation. The legislation helped drive the growth of partnership policies, further solidifying the role of LTCI in retirement planning.

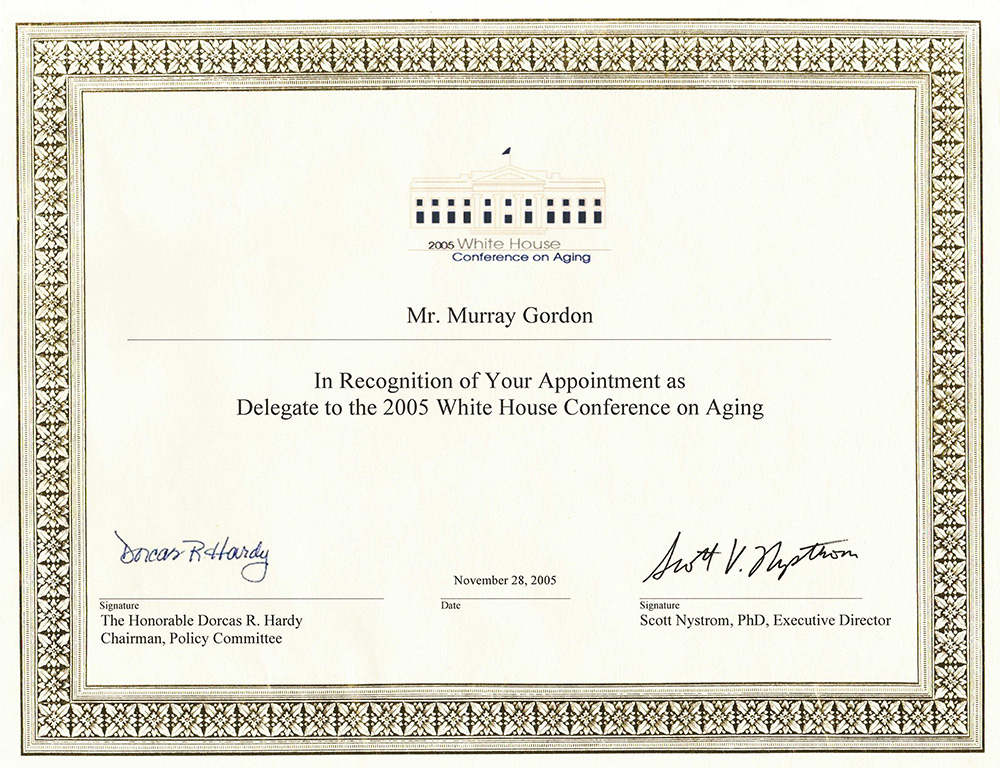

Murray Gordon was honored to serve as a delegate to the 2005 White House Conference on Aging, a prestigious event shaping the future of aging policies in the U.S. His involvement highlighted his commitment to advocating for better long term care solutions and improving the lives of elder adults nationwide.

GALTCI partnered with the Alliance of Comprehensive Planners (ACP), one of the largest networks of fee only financial planners in the U.S. This collaboration allowed him to provide trusted long term care solutions to clients seeking holistic financial planning and aging strategies.

Murray Gordon joined the board of AgeOptions, a leading organization dedicated to serving older adults and caregivers in the Chicagoland area. The following year, Gordon Associates introduced group long term care insurance to AgeOptions, providing valuable resources to support their mission. Murray remains an active board member, continuing to champion innovative solutions for aging populations.

As baby boomers began turning 65, a cultural shift emerged, sparking increased awareness around aging and long term care planning among younger generations.

Murray Gordon was honored with the Entrepreneur of the Year award by the Chicago Tribune, recognizing his exceptional leadership and innovation in the long term care industry. His vision and commitment to improving aging services set a new standard for excellence in the field.

Gordon Associates expanded its services by offering policy and claim consulting, allowing GALTC experts to become agents of record for long term care policyholders that did not have sufficient support from their original agents. This strategic move enhanced our business and provided additional policyholders comprehensive support, especially during the claim process.

Brian Gordon was invited to partner with and present at the NAPFA Fall Conference here in Chicago.

The COVID-19 pandemic significantly impacted long term care, highlighting the vulnerabilities in the industry and increasing demand for more robust, flexible care solutions for older adults. It accelerated the need for innovative approaches to care, including virtual services and enhanced safety protocols.

Brian Gordon was invited to present at the OneAmerica Independent Leaders Conference, sharing his expertise on long term care planning and leadership strategies. His insights contributed to the conference’s focus on innovative solutions for the evolving needs of the aging population.

A new publicly funded insurance program that raised public awareness on the importance for planning for a LTC event. The care fund also showed people the need to plan for their own future rather than relying on government programs that will fall short in the end.

A law in New York aimed at establishing a program to provide LTC services for residents of New York was introduced and currently sits in the senate. The program is designed to help people in need of long term care without depleting their income or assets.

Gordon Associates celebrated its 50th anniversary, marking five decades of dedication to providing exceptional long term care solutions and services.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes. To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning.